40+ How to calculate your borrowing capacity

Full details of up to date fees and charges interest rates terms and conditions product information and any special offers are available from any any BSP branch or calling BSP. Compare home buying options today.

What Are Some Of Ideas You Can Use To Pay Off Your Mortgage Quicker Quora

Lenders generally follow a basic formula to calculate your borrowing capacity.

. Your borrowing capacity is the maximum amount lenders will loan to you. View your borrowing capacity and estimated home loan repayments. You need to know how much you can borrow to help you decide the kind of home you.

Gross income - tax - living expenses - existing commitments - new commitments - buffer monthly surplus. Your borrowing capacity is calculated by adding your gross income deposit size and credit score. This video will show you how the Bank goes about calculating how muc.

Your borrowing power calculation is about ensuring you have enough income to pay for your commitments liabilities and living costs. Credit utilization is 30 of your credit score making it the second most important factor in determining your score. Estimate how much you can borrow for your home loan using our borrowing power calculator.

Before making an investment or home loan decision on the basis of the information provided by the Maximum Borrowing Capacity Calculator you need to consider whether the information is. Usually this can be calculated as follows. When it comes to existing mortgages lenders may.

View your borrowing capacity and estimated home loan repayments Banking. Free 40 Printable Loan Agreement Forms In Pdf Ms Word Even if this is not the only element taken into consideration. The lender wants to know how much.

Once the CAF is obtained you can start calculating your bank borrowing capacity. Borrowing capacity Self-financing capacity 3 or. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes.

Estimate how much you can borrow for your home loan using our borrowing power calculator. Keep in mind that a bank loan must help you to pay what you can instead of getting you into more debts. Not knowing Usury laws can worsen things for you.

How the borrowing power calculator works. This is why calculating a. Your expenses and other debts count against you.

Do you want to know how to calculate your borrowing capacity for residential home loans. Lenders generally follow a basic formula to calculate your borrowing capacity. To calculate your borrowing power we take into account a couple of key pieces of information your income and your debts.

You can calculate your credit utilization by using the. Estimate your maximum loan amount in two minutes Pre-qualify for your mortgage Your Income Note your gross income. Which is your income before taxes.

Knowing your mortgage borrowing capacity is one of the most important steps of owning a home. The Borrowing Power Formula. Amount Frequency Main source.

Heloc Calculator Calculate Available Home Equity Wowa Ca

Instant Crypto Credit Lines Borrow Against Crypto Nexo

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

Mortgage Refinance Guide Procedure Costs Calculator Wowa Ca

Private Mortgage Calculator 2022 Wowa Ca

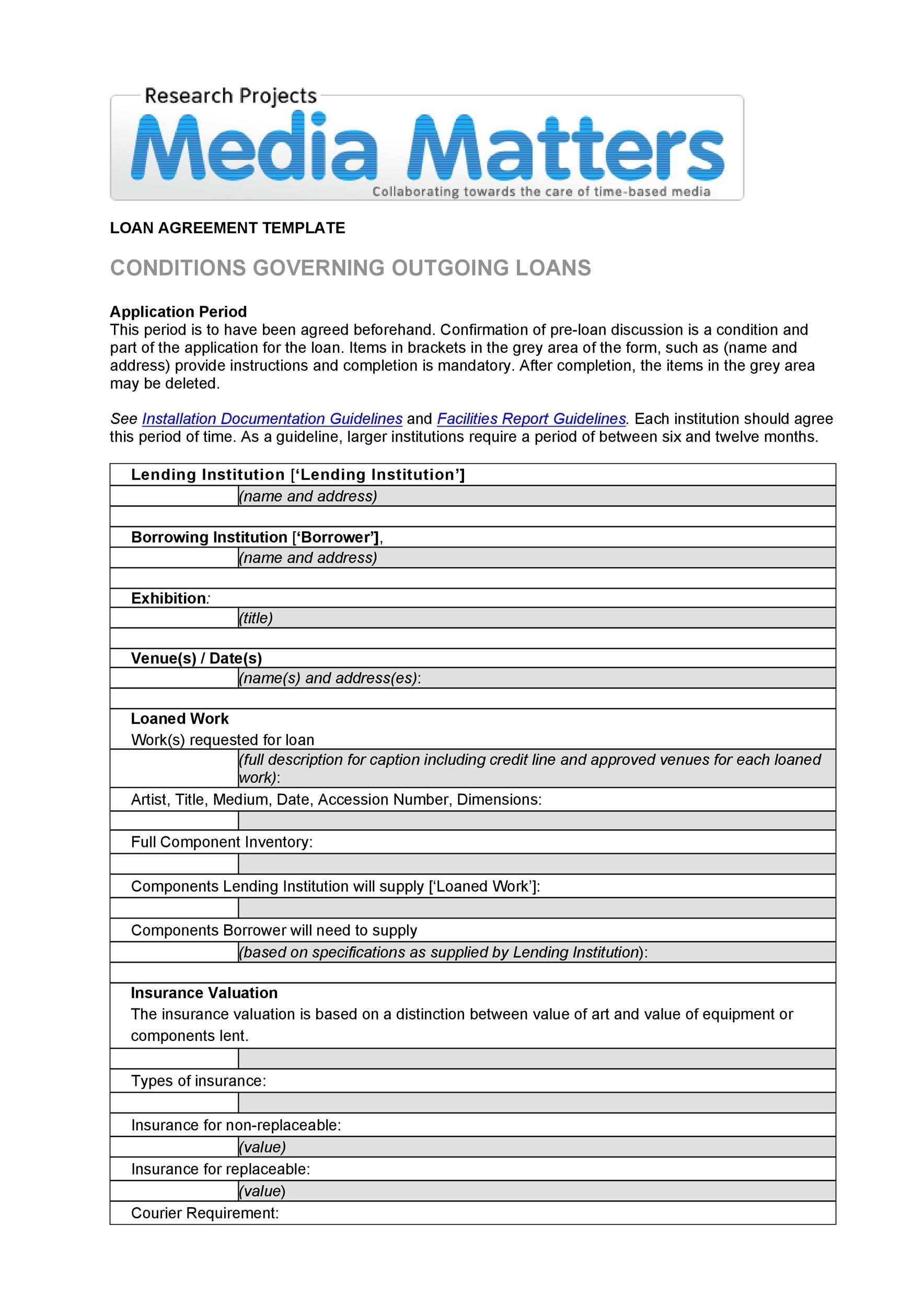

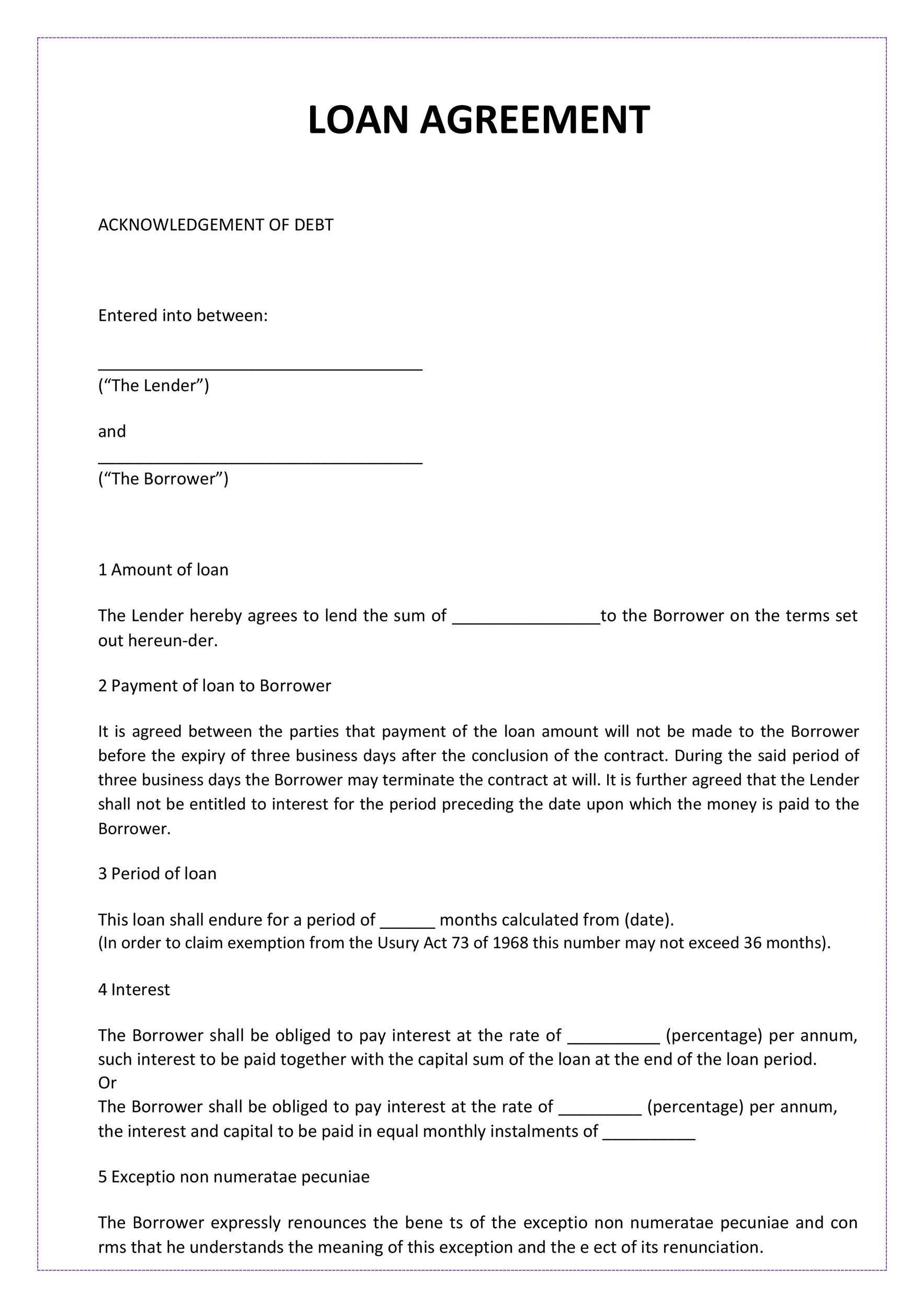

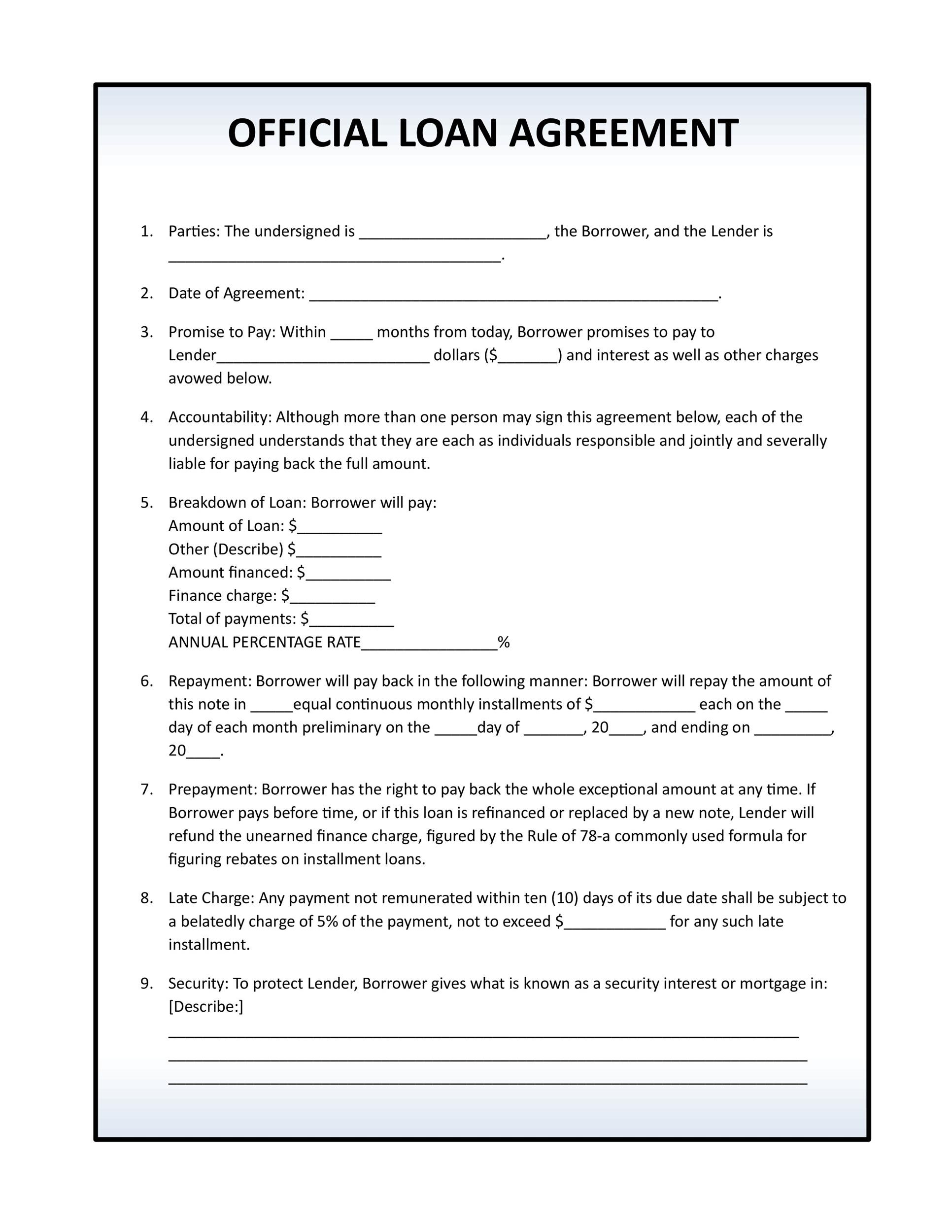

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

How To Use A Mortgage Calculator Comparewise

Download Personal Loan Agreement Template Pdf Rtf Word Doc Wikidownload Personal Loans Contract Template Loan Application

Easyhome Review 2022 Comparewise

Instant Crypto Credit Lines Borrow Against Crypto Nexo

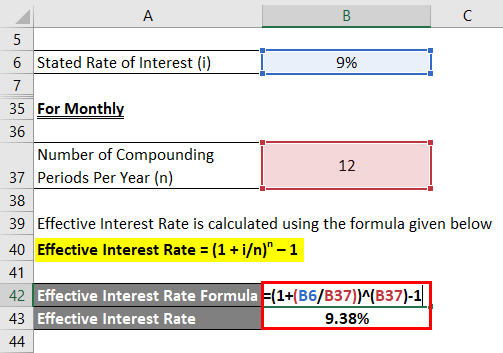

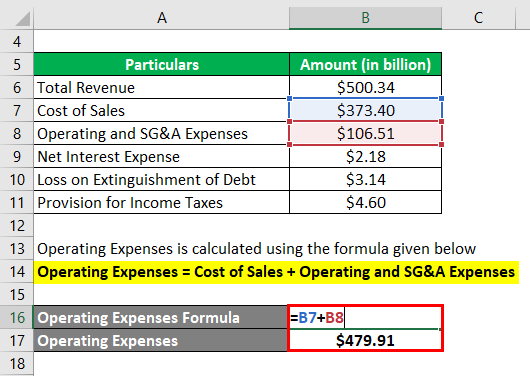

Effective Interest Rate Formula Calculator With Excel Template

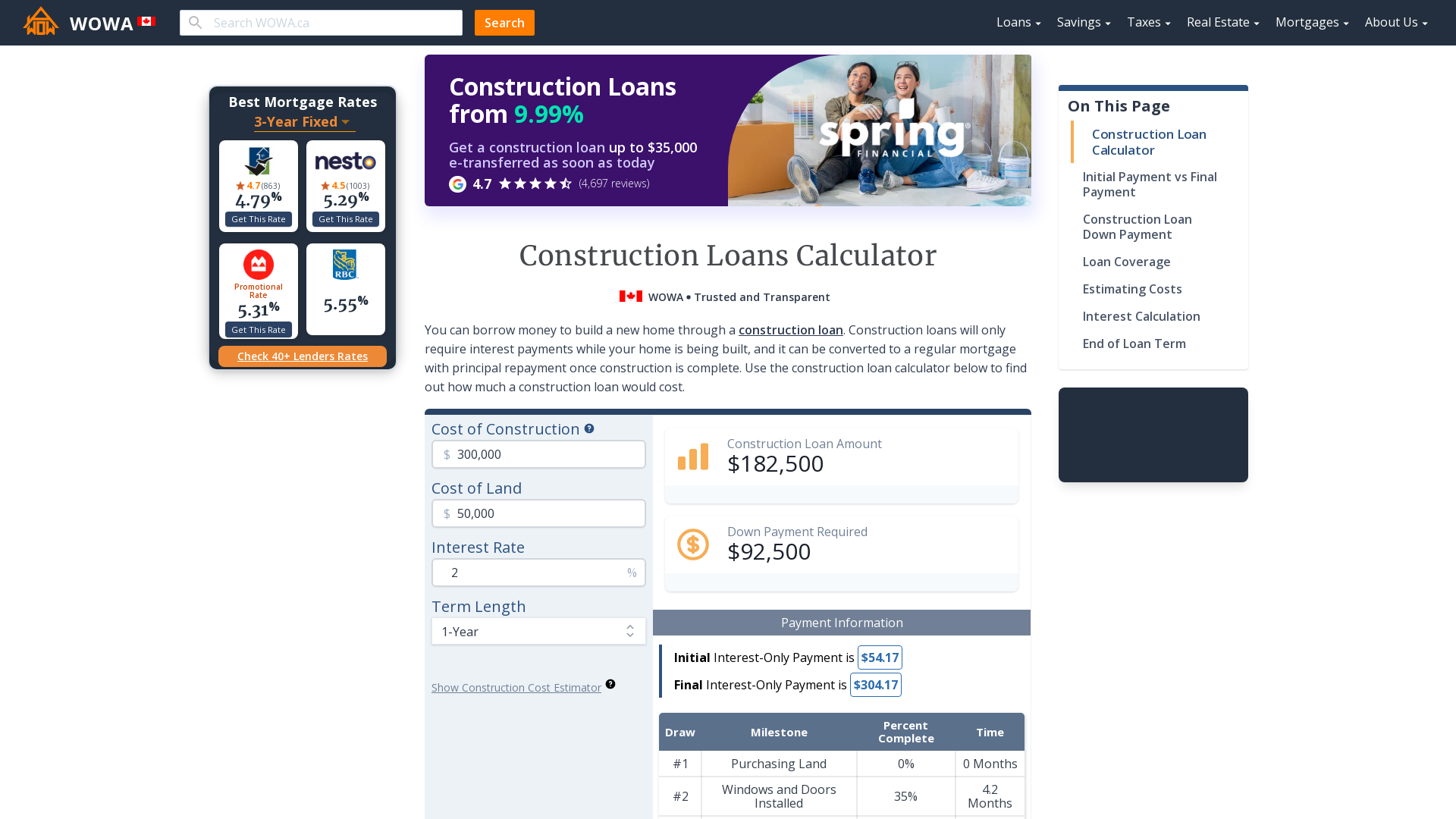

Construction Loan Calculator For Canadian Builders Wowa Ca

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

Profit Margin L Most Important Metric For Financial Analysis

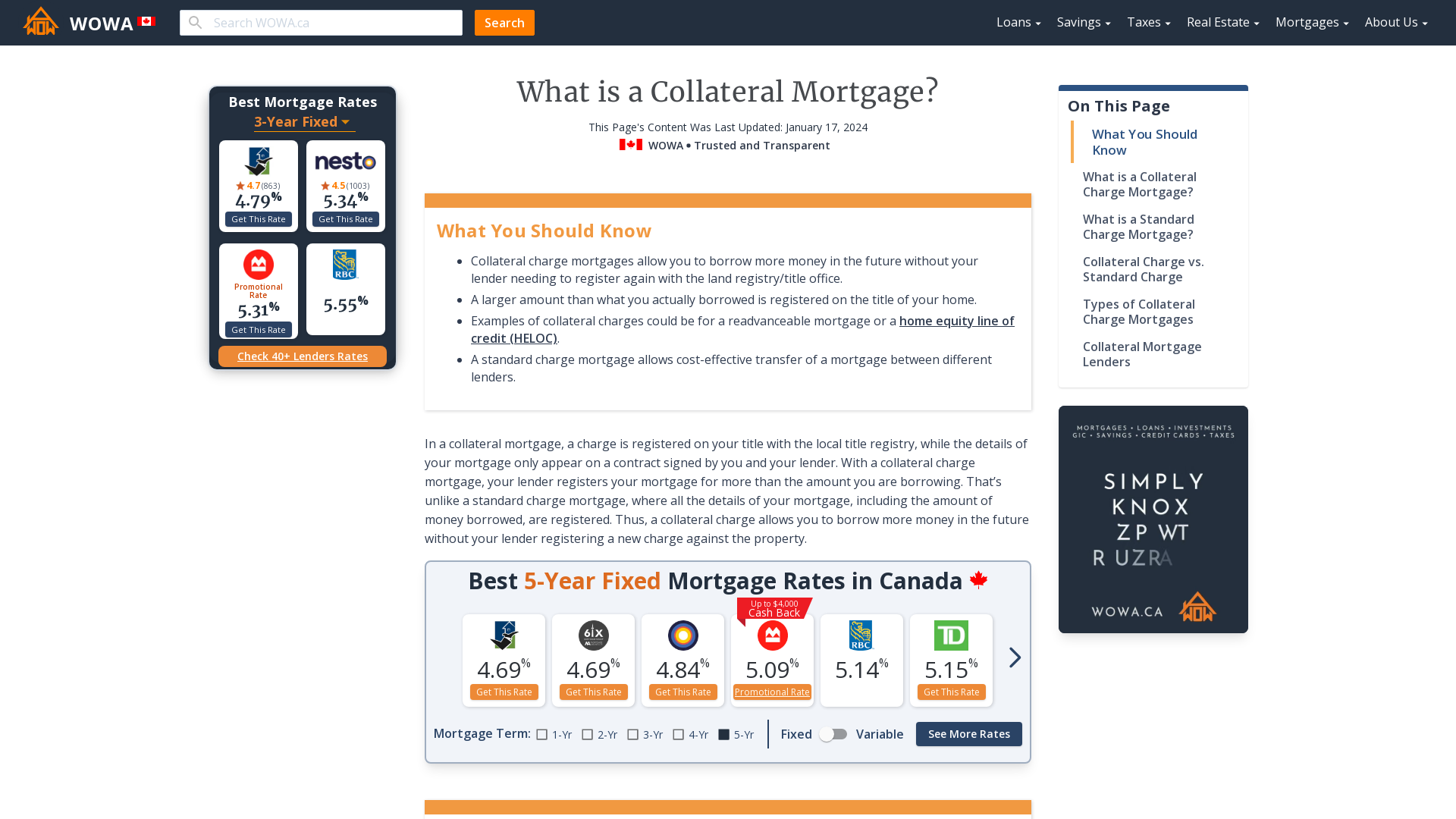

What Is A Collateral Mortgage Benefits Vs Risks Wowa Ca

Borrowing Power Calculator It S Simple Finance